Market Structure Stability Disclosure Service

This service is designed to improve structural environment transparency rather than forecast market direction. It provides systematic disclosure on whether the prevailing market regime is structurally stable, fragmented, or transitioning through a period of reorganization—conditions under which decision quality and risk outcomes can change materially even when asset-level narratives remain unchanged.

By focusing on participation persistence, structural membership continuity, and regime-level stability signals, the service supports disciplined exposure management and helps users distinguish between transient volatility and more durable structural transitions.

Why This Service Exists

Financial markets periodically enter regimes where conventional signal frameworks—whether discretionary or systematic— degrade in reliability due to shifting participation, rapid capital rotation, liquidity concentration changes, and structural breaks across correlated assets. In such environments, the primary source of adverse outcomes is often not “choosing the wrong instrument,” but operating under conditions where the regime itself is unstable and error tolerance collapses.

This service exists to provide an independent, repeatable view of the structural risk environment. Its goal is to help investors determine whether the current market regime supports stable decision-making conditions, or whether risk should be reduced and processes simplified until stability and continuity improve.

The emphasis is therefore on regime suitability and structural risk containment—supporting a “decision environment check” before strategy-level decisions are made.

What This Service Provides

This service does not predict market direction, generate trading signals, or recommend specific assets. Instead, it delivers systematic disclosure of market structural conditions—summarizing whether the market is consolidating, fragmenting, or reorganizing, and highlighting how persistent the underlying participation structure appears to be.

Reports are designed to be interpretable and operational: they inform whether the environment is suitable for execution, whether uncertainty is expanding, and whether stable structural membership is strengthening or weakening over time.

- Whether the current market environment is structurally stable enough for decision-making and execution planning

- Whether regime uncertainty is converging (stabilizing) or expanding (fragmenting) across the observed universe

- Which assets remain consistently recognized by the market structure, and which are losing structural membership

- Whether recent behavior is consistent with temporary volatility or indicates a potential regime-level structural transition

Core Methodology

The system operates through a multi-stage structural evaluation pipeline. Each stage is designed to reduce single-point model dependence by enforcing continuity requirements, robustness checks across parameter regimes, and validation across multiple time windows. The result is a regime-oriented disclosure workflow rather than a single-factor ranking output.

At a high level, the pipeline emphasizes survivability, persistence, and cross-regime consistency—then translates those structural properties into interpretable regime diagnostics such as coverage, churn, concentration, and continuity.

- Filters the U.S. global asset universe using long-horizon survivability constraints and data continuity requirements

- Identifies assets that persistently appear across independent parameter regimes to reduce single-setting dependence

- Verifies structural robustness across multiple time windows to separate durable structure from transient noise

- Applies tradability and long-horizon risk filters to avoid structurally fragile or operationally unstable exposures

- Measures structural coverage, churn, concentration, and continuity to characterize regime health and persistence

- Produces automated reports that disclose structural conditions and highlight regime transitions over time

What This Service Is Not

To avoid misinterpretation, the service is explicitly bounded in scope. It provides regime disclosure and structural risk-environment intelligence, but it does not attempt to replace investment decision-making, portfolio construction, or execution policies implemented by the user.

- Not investment advice, financial advice, or personalized suitability guidance

- Not a trading signal provider and not a timing engine for entries/exits

- Not a prediction system for future prices, returns, volatility, or macro outcomes

- Not a momentum ranking service and not a recommendation list of “what to buy”

Delivery

All structural environment reports are generated automatically by the system and delivered electronically in PDF format immediately after each processing cycle. Delivery is designed to be consistent and low-latency, with minimal operational dependency on manual intervention or discretionary handling.

Reports are distributed through electronic delivery channels to support timely access across locations and network conditions. If delivery is temporarily disrupted (for example, due to provider-side throttling, transient routing issues, or mailbox filtering), the system can retry delivery and preserve the latest report state for subsequent re-send or retrieval workflows.

Each report is timestamped and aligned with the structural evaluation window used by the system at generation time. This allows subscribers to track regime transitions, stability persistence, and structural change sequences as a continuous process rather than interpreting isolated snapshots.

Contact

Email: gsmatthew@icloud.com

Phone: +1 346 580 8817

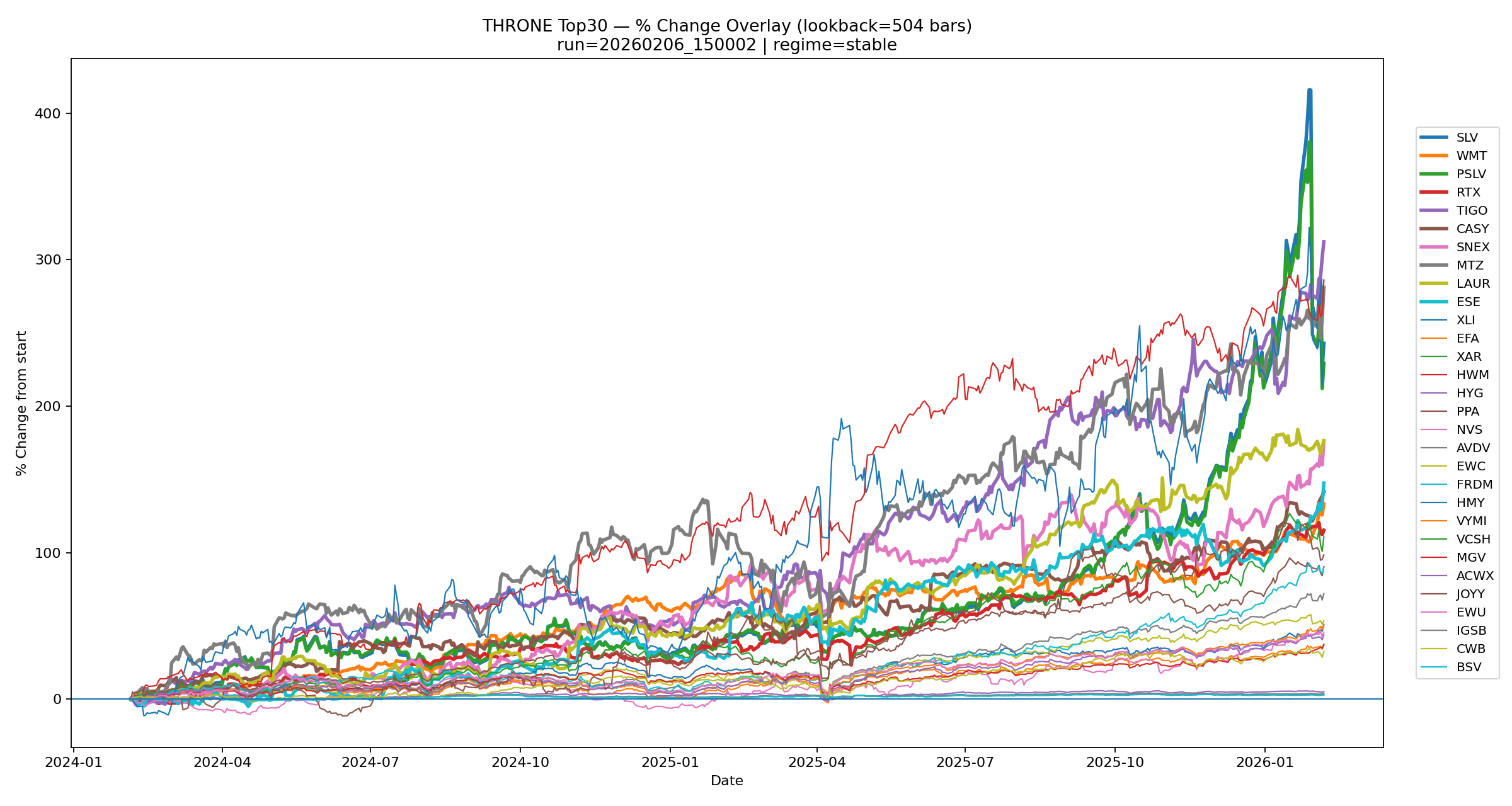

Latest Structural Snapshot

This snapshot reflects the most recent structural coverage distribution generated by the system. The image updates automatically after each processing cycle.

The snapshot displayed above is publicly accessible. Full longitudinal structural statistics, historical persistence analysis, and extended regime diagnostics are included exclusively in the subscriber reports. The daily snapshot serves primarily as a transparency reference, enabling subscribers to verify that the most recent structural outputs remain consistent with the delivered reporting cycle.